NO HOLIDAY FOR COST ACCOUNTING

2 DAYS HOLIDAY FOR MANAGEMENT (THEORY)

1 DAY HOLIDAY FOR AUDIT

1 DAY HOLIDAY FOR MANAGEMENT A/C

8 DAYS HOLIDAY FOR TAX.

NO HOLIDAY FOR COST ACCOUNTING

2 DAYS HOLIDAY FOR MANAGEMENT (THEORY)

1 DAY HOLIDAY FOR AUDIT

1 DAY HOLIDAY FOR MANAGEMENT A/C

8 DAYS HOLIDAY FOR TAX.

The page is for BAF Students, The page acts as a link between the Baf students with issues and the right person with its SOLUTION.

Issues may be related to :-

If you are facing any of the above problems, do write to us

At www.baf.co.in

Email us @ tybafmumbai@gmail.com

Also you can contact us at www.facebook.com/bafact

we make sure the identity of the person sharing the data with us, will be kept CONFIDENTIAL.

WE ARE NOT THE LAW MAKERS, BUT WE DO NOT SUPPORT BREAKING OF THE SAME.

TYBAF IS NOT EASY, AS WE TRY TO UNDERSTAND AND REMEMBER CONCEPTS OF NEARLY 45 CHAPTERS.

HENCE DO’S AND DONT’S ARE:-

“if you believe you can give yourself a chance, success will have no option!”

-BAF.co.in

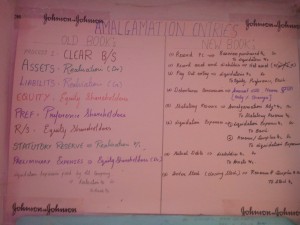

As we know amalgamation is a chapter which cannot be left for Option, hence its a compulsory chapter.

We get scared of this chapter for the only reason is, we do not know what are the maximum adjustments and concepts.

Hence here is a chart which consist of maximum entries possible as per us.

Also Firstly we need to close the old books of accounts. For that the flow should be: –

A brief explanation of the process :-

How to handle MERGER Sums and concept:-

if you are done with Amalgamation, then this will help you to revise the topic in Maximum 20 Minutes.

INTERNAL RECONSTRUCTION is again a simple chapter if you know the concept and the maximum adjustments.

hence here is a list of maximum adjustments and entries.

WE PREFER ALWAYS COMPLETE ENTRIES RELATED TO CAPITAL REDUCTION (Cr.) FIRST AND THEN GO FOR (Dr.)

For it will help you to realise, ho much balance do you have in Capital reduction to write off Fictitious & intangible assets.

Liquidation Does not require any shortcuts, for the chapter is absolutely format based, and its a standard format.

So All the shortcuts given will help only once you have done the chapters.

all the entries are taken comparing various textbook and notes, hence chances of error are minimal.

What chapter will come in option of what, cannot be predicted, all we are sure of that Amalgamation will have its own option, hence cannot be left.

Objectives can be done from behind the text book, and reading the chapters.

For answering theory questions, concepts should be clear.

Finally do not go for any thing new at this point of time, how much ever you know, make the best of it. All the best!

Cost Accounting is made up of 6 Chapters. Out of which Chapter No. 6. Introduction to emerging Concepts in Costing , will have no practical question.

Where as the First chapter- Uniform Costing and Inter firm comparison has Simple sums and theory, GO through the sums at-least once.

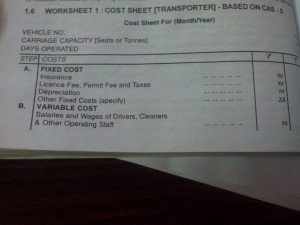

OPERATION COSTING.

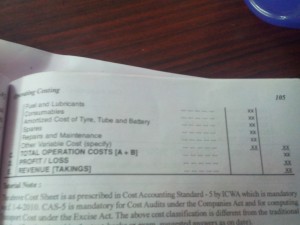

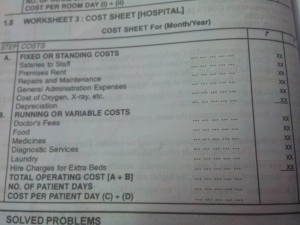

There are practical problems based on Costing of Goods & Passenger Transport, Hotel & Hospital.

For Goods & Passenger transport. There are specific formats for Standing/Fixed and Running/Variable cost. If there is a confusion in bifurcation of Costs, simply use CAS 5. And mention the same.

For Hotel, there is no fixed format, all the cost can be written one under the other.

For Hospital, there is a fixed format given Under CAS 5.

Working notes for calculations such as Passenger Kms etc will form part of answer. Hence make them neatly and do mention the Connecting working Note No.

Non Integrated & Integrated.

The only way to identify, weather its Integrated or Non Integrated sum is:- General adjustment A/c.

If GLA/CLC a/c is present then, its Non Integrated A/c.

Closing procedure for the A/c of Non Integral are:-

Also the maximum Entries possible (as per us) are Attached in Casting Short-cuts part 2

PROCESS COSTING

Its new for TYBAF, hence Practical problems related to Inter process Profits and WIP and Equivalent Production is expected(FIFO only)

Lastly it is advisable to go through the previous year papers before leaving for centre.

All the best.

Many students after the First paper for their graduation year(TYBAF) were found with tears!!!

On being asked, about the paper, major answer received was “UNEXPECTED”

Hence we went through the paper and found out the following reasons which broke them completely.

If you find that our observation are right, and you Support us for this carelessness of the Examination committee, Join the petition.

https://www.change.org/p/www-baf-co-in-carelessness-of-the-exam-committee-mumbai-university?recruiter=415994338&utm_source=share_petition&utm_medium=facebook&utm_campaign=share_for_starters_page&utm_term=des-lg-no_src-no_msg&fb_ref=Default

Firstly, Nowhere in the paper pattern it has been specified About Case studies. Hence NO case studies expected.

Now the question arises, then what to study from Ethics????

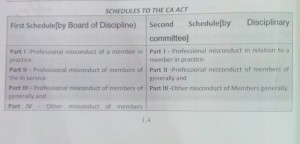

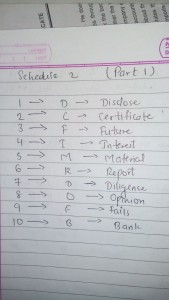

ANSWER: Read all the clauses well, Also all the clauses are divided into few categories, For eg; Schedule I has 4 parts, and Schedule II has 3 Parts, So these parts have been made because of Some specific reason, and that is, they have been categorised as per nature of the Misconduct.

Also a summary of part I of Schedule I and part I of Schedule II has been given for easy remembrance. All 34 clauses are applicable for the portion.

Other Important Questions having weight according to us:

Chapter 1

Rights, duties, liabilities of an auditor.

Types of audit.

Chapter 2

Audit Report and types of Audit report.

Reporting requirements.

CARO 2003.

Chapter 3

Nature and types of Environment and Problems of CIS.

From chapter 3 Short notes can also be asked.

Chapter 4

Disabilities for membership

Disabilities Procedure.

Past papers are mandatory before you go for the exam, hence go through them. (specially Tax audit and forms)

they are already uploaded at

http://baf.co.in/audit-past-year-question-papers-tybaf-sem-v-excluding-professional-ethics/

This is the Syllabus declared my Mumbai university, for the year 15-16 For TYBAF.

It consist of Vth and VI sem.

The FA paper was not enough to excite the students with, Mumbai university take things to all a new level with Direct tax paper.

As per the Published Paper pattern of Direct tax paper, Q 5 should be and option Between (a) or (b), where (a) consist of two question carrying 7 & 8 marks, whereas (b) should Contain short-notes, where students have to answer 3 out of 5.

The Paper had only 3 Short-notes, where no option for the same was given. But the surprise came in Few colleges @ 1 pm or at 1.20 pm(just 10 min before the paper getting over)

Students were given 2 short-notes to be added to the question paper, and they were 1) Assessment year & previous Year, 2) GAV(gross annual Value)

in comparison to other three which were printed in the paper, the new short-notes were extremely easy to attain.

Many students had left the centre by 1 PM, as there is no mandatory rule to sit till the end.

Another surprise came in was, Many colleges in Thane and Mumbai were NOT GIVEN THE OPTIONS AT ALL.

Students realised the same by the night, that other centres were given Option of 3 out of 5.

Students want to know from the Exam committee that, 8 days in hand to rectify any final changes required in the paper was not enough?

Mr.Deepak Wasave in his answer to Hindustan Times, Said that “Any changes in the paper are informed within 15 min from the paper begin”

Forget informing in 15 min, the Options were not provided at all in many colleges.

Not just students but also many Professors are disappointed with the event.

Students From Baf :” This is our Career exam”

How difficult it is to set 6 Papers without any mistakes and error.

Should Students get 15 marks for Unfair treatment of University??

The Most talked about FM lecture which was scheduled for 5th of Dec’15 at Andrews college, has been Postponed to 9th Dec’2015.

We have Attached the Official invitation as well as the Day plan.

For any query, you can speak directly with Prof. Abhishek sood : 9820449653/ Serissa fernandes(Student from Andrews college) 9769015487.

But what happened??

This is fact related to a Student Of TYBAF from MK COLLEGE Borivali.

5th Semester Exams are already in controversies relating to, Out of portion Questions in Management accounts, Printing errors, Lengthy Papers, Incomplete Question papers Etc. Against which a petition was filed Online with a support of more than 1700 students, but Mumbai university has not reacted on the same.

Facts of the Case:

Examination centre: Thakur College of Science and commerce Kandivali E

Mumbai University Graduation Exam TYBAF, 1st Paper Financial Accounting.

Students were allowed to go to their respective classrooms at 10.30 AM. Examination was scheduled for 11 A.M.

At 10.45 A.M. Room no.201.

Mrs. Rama Ray Co ordinator of Business Communication Thakur College was the appointed invigilator. After providing the required communication regarding keeping away bags, Declared that, “Students need to answer the Paper with Black ball pen.”

Listening to this, students started borrowing from each other the black ball pen, but This student from MK college rushed to her, being confused, for no such information was provided to her by her Co- ordinator or college(MK college Borivali w)

Where Prof. Rama Ma’am, went upto the Board, and wrote with Chalk ” THE PAPAER SHOULD BE WRITTEN WITH BLACK BALL PEN”

The Student requested her that, she has no black ball pen, but has a black gel pen, can she use the same??

On this Ma’am replied ” Black BALL pen only”, and guided the student to go down and buy a black ball pen” The time was approx 10.50 A.M (the paper time starts at 10.45 AM for filling the OMR Sheet)

The student rushed to the nearest stationery shop to buy a black ball pen, she found the shop near the Gate inside the campus.

But she faced issues again, as the stationery shop had only 2 variety of Black ball pens available, and she was missing out on time.She garbed one and ran back to her class.

Once she came in the class, Answer paper were in process to be distributed and by the time she settled, the Question paper distribution bell rang. Where Mrs.Rama ray said, ” If you’ll do not write with black ball pen, I am not sure weather your paper will be assessed or Not. (denning to take responsibility of the Answer sheets if not written with black ball pen)

The student missed most of her time to fill the OMR, and had to compensate her Question paper time for the same.

Now why are we highlighting this fact, where Mumbai university can miss out 2 options in the Tax paper, then this is quite minute in-front of that.

The reason is.

The students Name is Ayushi Agarwal, Studying in MK college since FYBAF. Pre that she was a student of Thakur college kandivali.

She has been ranking all the semesters with an AVERAGE of 83%.

On conversation with Ayushi we learned that, She had solved 2 Textbooks for each subjects, also a classes notes to get through the tough questions. To crack the objectives she had read the chapters of A/c as well.

She had cleared her CPT exams, and decided to Skip IPCC attempt for it was her desire to Rank the university.

She was very specific about her presentation of answers, and was appreciated for her innovation related to same by her Professors and friends.

For Eg; she used the same Gel pen since 5 years, by changing the refills, and hence when she was asked to use a Black ball pen, she faced a lot of difficulty adjusting to the same.

In our conversation with Ayushi, she said, ” I lost time because of which I was unable to make the balance sheet, many find this absolutely fine, but as per my preparations and planning, my first paper turned out to be a disaster. If I did not know the Concepts and sums, i would be all fine, for it would be my mistake. But here I dont find my mistake but still had to pay for it by leaving out marks, which I knew.”

In our conversation with MR. Manikandan (Principal MK college), “There was no such notice that we received, regarding use of black ball pen, And it is not right on the part of any prof. to give out such statement to students on the examination day”

In our conversation with Mrs. Rama Ray(over call), “I have followed the Rule, and we have informed out students(Thakur college) on the day of distribution of hall ticket itself for the use of black ball pen. If college has not informed the students, its the colleges fault.

Miss Leena ( BAF co- ordinator, MK college) gave no comment.

A student has many reason to bear, for everything, where its not their mistake. We have not found any notice from University stating use of Only Black ball pen For TYBAF examination as it makes no sense,as papers are corrected by Prof. and not machines. No such rule Exist even at CA final level.

Do you think This student deserves to be reimbursed, or we should let it go like always.

Do comment!

TYBcom results came up in December’15, which was early as expected by the students, Not just Grades, but Marks were displayed online.

There are many Rumours about the Declaration of TYBAF results. Where as per current status, The Results are expected in the First week of FEB’16. they are hardly expected in this Month.

So it is advisable to Focus on the 6th Sem, rather then getting worried for the Results.

We will keep you updated, and Once the results are Out, will share the Link here